Investment Strategy

What is Investing Strategies ?

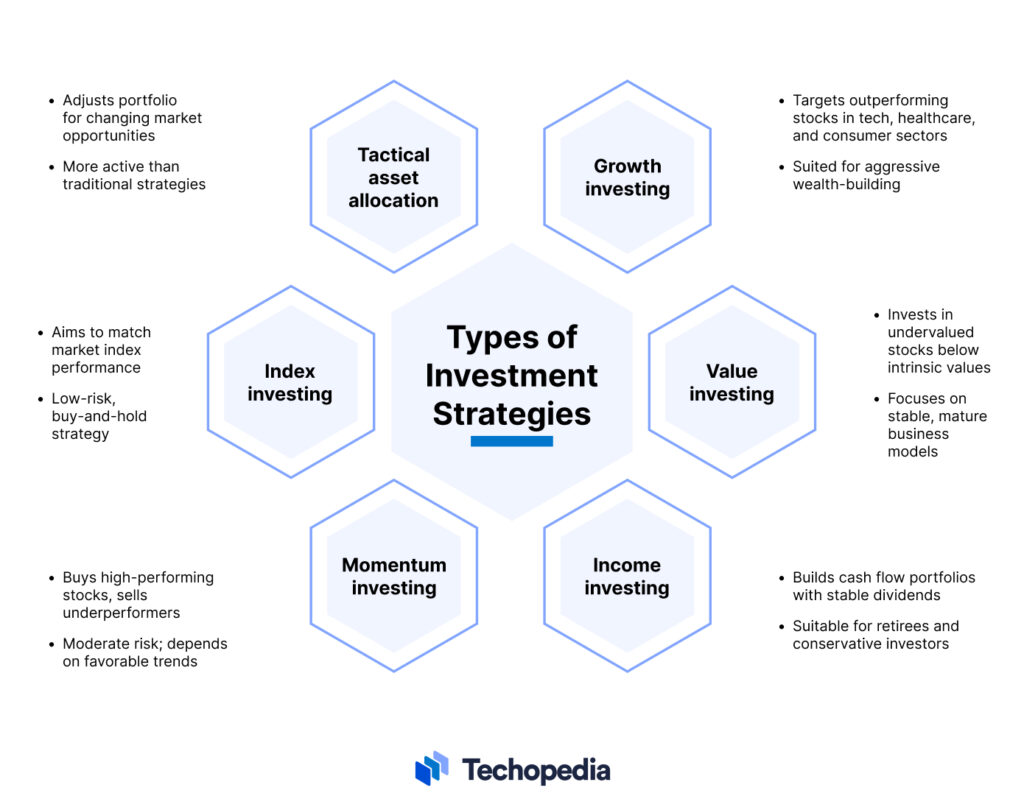

Investing strategies are the methodical plans and techniques that investors employ to divide their money among different financial instruments, including stocks, bonds, real estate, or other assets, in order to meet certain financial objectives. An investor’s risk tolerance, investment horizon, financial objectives, and market circumstances can all influence the choice of strategy. These are a few typical investment techniques:

How Does Work Investing Strategies

Value Investing

Principle: Use fundamental analysis to purchase undervalued stocks.

Objective: Invest in equities that are undervalued in order to generate long-term growth.

Warren Buffett and Benjamin Graham are important figures.Look for undervalued stocks or assets with strong fundamentals.

Growth Investing

Principle: Invest in companies that exhibit signs of above-average growth, even if the stock price appears expensive in terms of metrics like P/E ratio.

Goal: Capital appreciation by investing in companies expected to grow at an above-average rate.

Focus on stocks or assets with high growth potential.

Key Figures: Philip Fisher, Thomas Rowe Price Jr.

Income Investing

Principle: Focus on generating a steady income stream from investments, typically through dividends or interest payments.

Goal: Generate regular income, often used by retirees.

Key Instruments: Dividend-paying stocks, bonds, real estate.

Index Investing

Principle: Replicate the performance of a specific market index, such as the S&P 500.

Goal: Achieve broad market exposure and benefit from overall market growth

.Key Tools: Index funds, ETFs.

Momentum Investing

Principle: Buy securities that have had high returns over a recent period and sell those that have had poor returns.

Goal: Capitalize on market trends and the momentum of stock price movements. Invest in stocks or assets with strong price momentum.

Key Figures: Richard Driehaus.

Dollar-Cost Averaging

Principle: Invest a fixed amount of money at regular intervals, regardless of the asset’s price.

Goal: Reduce the impact of volatility by spreading out investments over time.

Key Practice: Regular investments in a 401(k) plan.

Contrarian Investing

Principle: Invest against prevailing market trends by buying poorly performing assets and selling well-performing ones.

Goal: Profit from market overreactions and corrections.

Key Figures: John Templeton, David Dreman.

Risk Parity

Principle: Allocate investments based on risk rather than capital.

Goal: Achieve balanced risk exposure across various asset classes.

Key Figures: Ray Dalio.

Buy and Hold

Principle: Invest in stocks and keep them for a very long time, even in the face of market volatility.

Goal: Benefit from long-term market growth and compound interest.

Key Figures: Warren Buffett.

Speculative Investing

Principle: Take high-risk positions in the hope of substantial returns.

Goal: Achieve high returns through significant price movements in a short period.

Key Tools: Options, futures, cryptocurrencies.

Risk management: Use strategies like hedging, stop-loss orders, or diversification to manage risk.

Tax-efficient investing: Optimize investments to minimize tax liabilities.

Impact investing: Invest in companies or projects that align with social or environmental values.

ESG (Environmental, Social, and Governance) investing: Consider non-financial factors in investment decisions.

Active vs. passive investing: Choose between actively managed funds or passive index-tracking funds.

Key Considerations in Choosing an Investing Strategy:

Risk Tolerance: The level of risk an investor is willing to take.

Investment Horizon: The period an investor plans to hold their investments.

Financial Goals: Objectives such as retirement, education, or wealth accumulation.

Market Conditions: Current economic and market environment.

Investing and Trading Strategies of typs

Investing and trading strategies vary significantly in terms of time horizon, approach, and risk tolerance. Here’s an overview of different strategies:

Long-Term Investing

Time Horizon: Typically 5 years or more.

Approach: Buy and hold investments for an extended period to benefit from compounding and long-term growth.

Risk Tolerance: Generally moderate to high, as long-term investors are willing to endure short-term volatility for potential long-term gains.

Key Principles:

>Patience and discipline.

>Focus on fundamental analysis.

>Diversification.

Examples: Investing in stocks, bonds, real estate, retirement accounts.

Short-Term Trading

Time Frame: Several days to a few weeks.

Approach: Buying and selling financial instruments to capitalize on short-term price movements.

Risk Tolerance: High, due to the need to respond quickly to market changes and the potential for significant losses.

Key Principles:

>Technical analysis.

>Quick decision-making.

>Risk management strategies.

Examples: Trading individual stocks, options, or ETFs based on short-term price trends.

Swing Trading

Time Horizon: Several days to several weeks.

Approach: Taking advantage of short- to medium-term price trends and patterns.

Risk Tolerance: High, with a focus on timing the market to capture swings in stock prices.

Key Principles:

>Technical analysis.

>Identifying trend reversals and continuation patterns.

>Managing risk and setting stop-loss orders.

Examples: Trading stocks, options, or forex to profit from expected price movements.

Day Trading

Time Horizon: Within the same trading day.

Approach: Buying and selling financial instruments within a single trading day to exploit intraday price movements.

Risk Tolerance: Very high, as positions are closed by the end of the trading day to avoid overnight risk.

Key Principles:

>Technical analysis and real-time data.

>Fast decision-making and execution.

>Strict risk management and capital preservation.

Examples: Trading stocks, forex, or futures based on intraday price patterns.

Scalping

Time Horizon: Seconds to minutes.

Approach: Making numerous trades to capture small price changes within a very short period.

Risk Tolerance: Extremely high, as scalping requires intense focus, quick reflexes, and the ability to execute trades rapidly.

Key Principles:

>High-frequency trading techniques.

>Leveraging advanced >trading platforms and technology.

>Tight risk management and quick profit-taking.

Examples: Trading high-volume stocks, forex pairs, or futures contracts with small profit targets per trade.

Key Differences Between Strategies

Time Horizon: Long-term investing focuses on years, while trading strategies range from months (swing trading) to minutes (scalping).

Risk Tolerance: Long-term investing typically has a lower risk tolerance compared to trading strategies, which require higher risk tolerance due to the rapid market movements.

Approach: Long-term investing relies more on fundamental analysis and the overall growth potential of investments, whereas trading strategies emphasize technical analysis and market timing.

Execution: Long-term investing involves fewer transactions and lower transaction costs, while trading strategies involve frequent trades and higher costs associated with trading activity.